Is Exness Regulated? Understanding the Regulatory Landscape

As a trader, you might often hear discussions revolving around broker regulations, and one name that frequently emerges is Exness. But is exness regulated https://latam-webtrading.com/en/exness-ghana/? In this article, we will delve into the intricacies of Exness’s regulatory status, its implications for traders, and why regulation is crucial for trading security.

The Importance of Regulation in Forex Trading

Regulation plays a vital role in the forex trading environment. When a broker is regulated, it means they are subjected to a set of standards and compliance protocols imposed by financial authorities designed to protect traders. These regulations help ensure transparency, fairness, and security in trading operations.

Traders often seek out regulated brokers because they reduce risks associated with fraud, mismanagement, and insolvency. Regulation helps foster trust between traders and brokers, which is essential for the overall health of the trading ecosystem.

A Look at Exness

Founded in 2008, Exness has grown to become one of the prominent players in the online trading industry. The company offers a wide range of financial instruments, including forex, cryptocurrencies, commodities, and stocks. But, is Exness regulated?

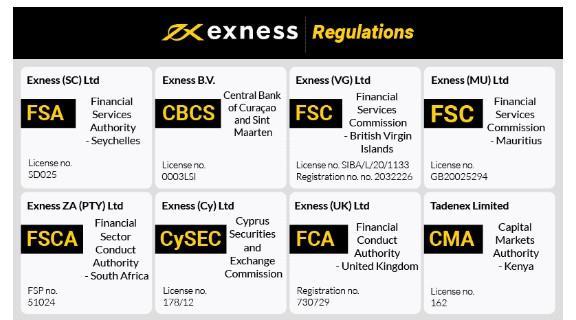

Yes, Exness is regulated by several financial authorities in various jurisdictions. Its operations are under the oversight of the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and other local regulatory bodies. The multi-jurisdictional regulation exemplifies the company’s commitment to maintaining high standards of trading practices.

Exness’s Regulatory Bodies

1. Financial Conduct Authority (FCA)

The FCA, based in the United Kingdom, is one of the most respected regulatory agencies globally. Exness is authorized by the FCA with the license number 730729. This regulatory oversight ensures that Exness adheres to strict standards, including maintaining client funds in separate accounts and offering negative balance protection.

2. Cyprus Securities and Exchange Commission (CySEC)

Exness is also regulated by CySEC under the license number 178/12. Regulation by CySEC allows Exness to operate in Europe and offers traders added protection, including compensation schemes that can reimburse clients in case of broker insolvency.

3. Other Regulations

In addition to FCA and CySEC, Exness holds licenses from other jurisdictions, including the South African Financial Sector Conduct Authority (FSCA) and the Australian Securities and Investments Commission (ASIC). These regulations reflect Exness’s aim to cater to a global audience while adhering to local laws.

The Benefits of Trading with a Regulated Broker like Exness

Choosing a regulated broker like Exness comes with a plethora of benefits:

- Security of Funds: Client funds are typically held in segregated accounts, reducing the risk of loss in the event the broker faces financial difficulties.

- Fair Trading Conditions: Regulations require brokers to provide fair and transparent trading conditions, ensuring that traders are treated equitably.

- Dispute Resolution: In case of any disputes, regulatory bodies provide mechanisms for resolution, safeguarding the rights of traders.

- Compliance Checks: Regular audits and compliance checks ensure that the broker adheres to ethical trading practices, providing peace of mind to traders.

Common Misconceptions about Regulation

Despite the importance of regulation, there are several misconceptions that traders have regarding regulated brokers like Exness:

1. All Regulation is Equal

Not all regulatory bodies carry the same weight. For instance, FCA and ASIC are viewed as very stringent regulators, while certain offshore regulators may not possess the same level of rigor.

2. Regulation Guarantees Profits

While regulation helps mitigate risks associated with fraud, it does not guarantee profits. The forex market is inherently volatile, and traders must exercise proper risk management practices regardless of the broker’s regulatory status.

Conclusion

In summary, Exness is indeed a regulated broker with oversight from multiple esteemed regulatory authorities, including the FCA and CySEC. As a trader, it is essential to conduct thorough research on a broker’s regulatory status, as it significantly impacts your trading safety and experience.

By choosing to trade with Exness, you are engaging with a broker that is committed to providing a secure trading environment, backed by stringent regulations that protect your interests as a trader. Always remember that while regulation is a crucial factor, your trading success depends on your skills, strategies, and risk management practices.